blog, floors, walls

As we enter a new year, the world of design is abuzz with excitement over the latest trends and styles. And when it comes to home decor, one of the most exciting aspects is the ever-evolving world of tile design. From classic ceramic to modern mosaic, tiles offer endless possibilities for adding texture, colour, and personality to your home.

So what can we expect in 2023? Here’s a look at the big names in design forecasting and their predictions for the year ahead.

One of the major players in design forecasting is Pantone, the authority on colour trends.

For 2023, they predict a trend towards earthy, nature-inspired hues such as olive greens, warm browns, and deep blues. These colours create a sense of calm and serenity, and can help to bring the outdoors inside. In terms of tile design, we can expect to see a lot of earthy tones and organic textures, including natural stone and wood-look tiles. These tiles will add a warm, inviting feel to any space and are perfect for creating a cozy, welcoming atmosphere.

Next, we have Houzz, the popular home design website.

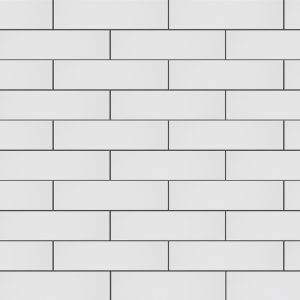

They predict that geometric tiles will be a big trend in 2023. These tiles feature bold shapes and patterns, often in contrasting colours. They can be used to create eye-catching feature walls or to add interest to a backsplash or shower enclosure.

Another trend they anticipate is the use of large-format tiles, which can create a sleek, modern look in any space.

Interior designer Emily Henderson is also weighing in on the tile trends for 2023.

She predicts that terrazzo tiles will be a major player in the coming year. These tiles feature a mix of chips or fragments of marble, quartz, granite, glass, and other materials, which are then poured into a cement or epoxy base. The result is a unique, speckled appearance that’s perfect for adding texture and interest to floors, walls, and countertops.

Finally, we have the design team at Elle Decor.

They’re predicting a return to classic materials and styles in 2023, including subway tiles and hexagonal tiles. These timeless designs never go out of style and can add a touch of elegance to any space. They’re also anticipating a rise in artisanal and handcrafted tiles, which offer a unique, one-of-a-kind look that can’t be replicated by mass-produced products.

Whether you’re a DIY homeowner or an interior designer, these tile trends for 2023 offer plenty of inspiration for your next project. From soft pastels to bold geometric patterns, there’s something for every style and taste.

So, go ahead and start planning your tile makeover today – the possibilities are endless!

blog, walls

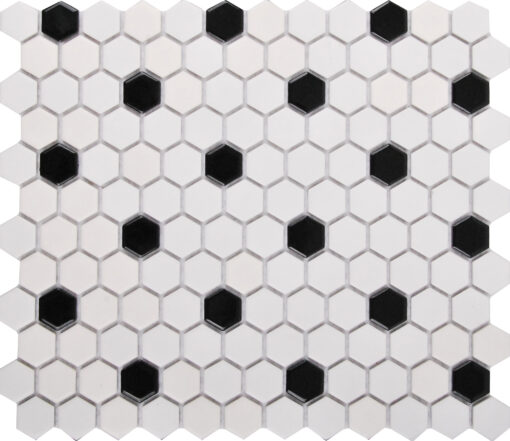

Mosaic tiles are timeless, and they are great for a contemporary setting. They are arrangements of small pieces of hard material displayed together to create a picture or pattern. Stone, tile, and glass are all perfect materials for this type of display and make for beautiful finishes when installed. The stylish designs are drawn from the history of mosaics and give off a rich decorative design heritage, with a contemporary twist. When buying mosaics for your home, they typically come in separate sheets that can be arranged together to make the process of displaying a large quantity much easier.

Here are our top 5 ways to use mosaic tiles in your home:

Above: Fan white gloss mosaic

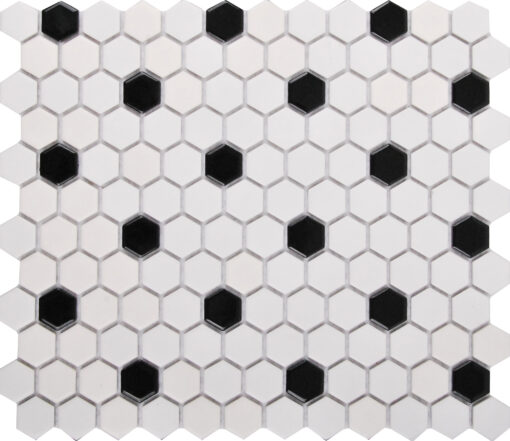

1. Using mosaic tiles in your bathroom

Mosaic flooring can be used in your bathroom to give your home the rich and luxurious pick-me-up it deserves. Using them is an attractive and stylish choice that will outline any passing trend. They will never run out of fashion because they have the same characteristics as larger tiles. They are strong, clean, and versatile. The most common use for mosaic tiles within a bathroom is to create a patterned effect. You can choose to use a small section of mosaic tiles to accent a piece within the bathroom such as a basin or vanity unit. This can look quite effective in making a statement to focal points within the bathroom.

Above: Hexagon white matt/gloss black dots porcelain tiles

2. What mosaic tile pattern to use in the kitchen

The kitchen is known to be the heart of your home, and using mosaic walls for the backsplash often adds style to it and gives it a unique look. To add a new backsplash for a neutral kitchen, you can add a mosaic pattern that features warm, contemporary browns, or contrast with cool blues and trendy greys. You can emphasize the contrast by adding smoky accessories.

Above: Autumn fairy speckled charcoal kit-kat tiles

Above: Autumn fairy ocean aqua

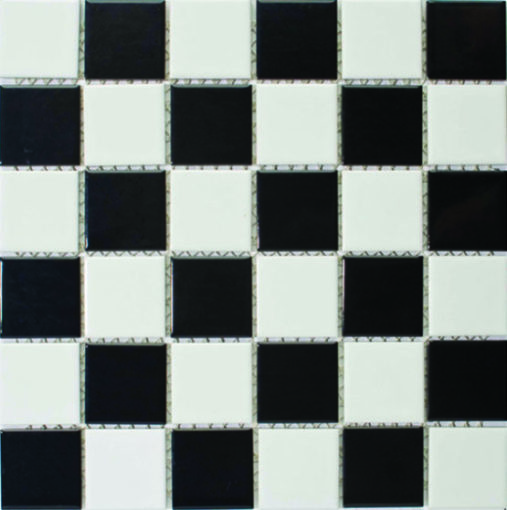

3. Using brick mosaic tiles in the shower

Brick mosaic tiles will not lose their quality because they have been installed in the shower. They can sustain a lot of water, humidity, and steam. They have the potential to liven up a bathroom to a more bright and beautiful space, which is extremely easy to clean. Mosaic tiles give a high-end luxurious look to the bathroom and the small tiles create an interesting texture.

Above: Herringbone milk white

4. Can mosaic tiles be used outside

Although mosaic tiles make a great addition to outdoor spaces, they require a different application to ensure they are safe from water and outdoor elements. You can make use of outside mosaic tiles to bring a unique and colourful finish to your outdoor space. When installing mosaic tiles outside, use a concrete backer rather than wood, as wood will swell and contract based on humidity changes, so the tiles will eventually begin to fall off.

Above: Black white gloss check mosaic wall tiles

5. How to give your fireplace an ultimate facelift with mosaic tiles

Mosaic fireplaces are not made inside of the fireplace itself but are made by applying mosaic to the surrounding face. The fireplace surround can be mosaicked with a variety of materials, including glass tile. For outdoor mosaics subject to rain, humidity, and freezing temperatures, thin set mortar should be used instead of adhesive to mount tiles.

Above: Nocturnal crescent cladding

Tile used in mosaic has a track record of durability and performance, making it one of the most capital efficient surface finishing materials over time. Unlike other flooring products such as carpet, vinyl, and laminate flooring, glass and natural stone tile last for a lifetime with little maintenance or wear. Mosaic artwork is the type of décor that does not harm the environment, as you will not need any type of chemicals to clean them. You need not worry about it deteriorating, getting damaged or getting outdated because mosaic will always look exquisite and stylish.

A large-scale mosaic art on your wall will inspire awe and admiration from your visitors, regardless of its theme.

So, any time you’re craving a little design refresh of your home interior or external façade of your home or building, there are a myriad of ways to do so.

Check out our range of mosaic tiles here

For more insight on how to use Mosaic Tiles in your home, visit your nearest Tiletoria showroom.

blog, robin sprong wallpapers blog

The season of new beginnings is in the air – it’s officially spring!

We’ve put together our top picks of Robin Sprong spring-inspired wallpaper designs, to visualize the change of season.

“The foundation for Uta’s work centers around floral motifs, colour, and nature. For many years, Uta has collected books featuring antique illustrations, drawings of historical pharmacy plants, lush tropical vegetation, and roses, specifically.”

Hummingbirds and Tropical Flowers

In Spring, hummingbirds start to visit flowering plants and nectar feeders. Many people believe that Hummingbirds symbolize joy, healing, and good luck.

Vintage Sepia Bird and Flower Jungle

The perfect symbol of spring, with bright flowers in bloom. The vibrant bright yellow background represents the colour of “happiness, and optimism, of enlightenment and creativity, sunshine and spring.”

Colorful Birds and Redouté Flowers

Redouté was a painter and botanist from Belgium, known for his watercolours of roses, lilies, and other flowers (Arts & Culture).

“Este’s works are inspired by themes such as travel, nature, dreams, seasons, and sentiments. The layering of colours within her designs, including simplified plant forms & her trademark floral depictions, ensure freshness and vibrant energy throughout her work.”

Cosmos

Cosmos flowers are the best know for attracting birds, bees, and butterflies to the garden.

Y029 Compo

Green Starling

Dawn

Mexican colours

Bright, bold, birds and botanicals are how we would best describe these wallpapers…and the new season!

Feliz

‘Feliz’ is the Spanish word for ‘happy’, perfect for this happy season.

Lindias Kitchen

Daisies are the perfect representation of the season of rebirth and renewal. They symbolize motherhood and childbirth. “With their yellow centers surrounded by fresh, white petals, daisies have an effortless beauty that we can’t help but love” – Curate Florals.

Bloom

The definition of Bloom is “to produce or yield flowers”, a perfect representation for the season of blooming flowers.

“Amelia’s passion and outlook in creating beautiful living spaces for her clients are born from her global travels across Africa, Australasia, Asia, and Europe. Find the right combination of stunning colours, mix in a passion for textures, and add a huge splash of creativity to create your own unique and gorgeous spaces.”

Agapantha

Blossom

Passion Flower

Pansy

Welcome the season of new beginnings by introducing spring flowers and blooming plants into your space.

“Jane and Jann are inspired by the African textile tradition, rendered in a modern urban context with its blending of diverse sources and influences to create the fabric of a nation.”

After The Fire Colour

This artwork is a great representation of a South African Spring. “The protea is one of the most fascinating plants on earth and, of course, South Africa’s national flower. These beautiful plants attract various birds and insects like sunbirds and bees with their rich, sweet nectar. Proteas, is referred to as fire-loving vegetation, and in need to burn every few years to survive” – Anita Froneman

5. Room 13 collection

“What initially started off as a passion project has developed into a fully-fledged sister company, Room 13 Collection. From [their] fantastical signature botanicals to more subtle geometric and textured designs, [their] 3 Wallpaper Collections covers it all.”

Eden Navy

“A strain of the earth’s sweet being in the beginning in Eden garden.” – Gerard Manley Hopkins (Spring Stanza 2)

“Spring is a lot like the good old times in the biblical Garden of Eden. The bounty and joy of spring can be compared to the sweetness and bounty of the Garden of Eden.”

Willie Schlechter mainly works within the genre of botanical art. He is an award-winning artist and his art has been showcased in multiple exhibitions. “Many of his works are digitally printed onto textiles, wallpaper, ceramics, and sold as limited edition prints.”

Bee and Moth Colour

Spring is the most important and busiest time of the year for honeybees. The worker bees in spring are busy finding food for their colony as soon as the first source of pollen emerges. This is also the queen’s mating and egg production season. (Sioux Honey)

During Spring, young caterpillars emerge. That’s when they begin feeding on all the new tree leaves! After eating for about a month, the caterpillars rest in their pupal cases. A few months later, they emerge as white or brown-winged moths. They then get ready to lay eggs and start the whole process over! (Davey)

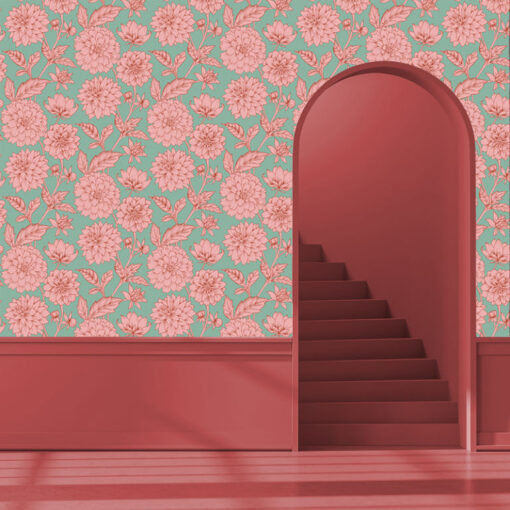

“Robyn is a Cape Town based designer with a passion for historic and floral pattern styles. She has created a beautiful collection featuring dahlia flowers, hummingbirds, and other petite florals.”

Dahlia Blooms Green Pink

The best planting time for dahlias is in late spring when all danger of frost is over and the weather is nice and warm (Gardening in South Africa). They are common wedding flowers, a symbol of commitment and an everlasting union. They also represent inner strength, creativity, and elegance (Bunches Direct).

“Jessica loves to illustrate the feeling of fun, whimsical movement combined with the opulent abundance of the natural world. Carrying a deep appreciation for the principles of Feng Shui, she believes that surrounding oneself in inspired beauty generates uplifting energy and inspired life.”

Pond – Green

This wallpaper is one of the most popular, and we can see why. The eye is automatically drawn to the bright pops of flowers, in between a beautifully illustrated pond.

To see more of Robin Sprongs amazing collection of wallpapers, wall decals, tile stickers, and shower panel vinyls, visit one of our showrooms today.

bathroom, blog, how to articles, robin sprong wallpapers blog

When picking my wallpaper, how important are the colours and fixtures in my bathroom?

Clients most commonly come to us with their bathroom almost complete. By this stage, it is usual to see that a colour palette has been chosen, alongside matching fixtures objects like the shower rail, washbasin and taps, shower/bath and taps, and floor tiles.

So, we often end up creating a design that fits in with the style of the bathroom that’s already present.

In a perfect world, you might choose to plan your bathroom wallpaper earlier when planning the design of your bathroom overall – but more often than not, building practices are drawn out and stressful and there’s more of a focus on getting this side of the process started as soon as possible.

Thus, it’s a popular approach to pick neutral tones and muted hues that will blend well with the rest of your design choices for your bathroom.

Have a look at these elegant wallpaper panels we created to style a client’s bathroom. It adds to the atmosphere of the room, but subtly as an elegant design that punctuates adds some flair to the neutral-coloured nature of the space.

If you’ve already defined the look for your bathroom, stay in line with the theme broadly but don’t be afraid to stray slightly to add some contrast and creativity.

For a small bathroom space, having a feature wall with a design that draws the eye into the scene and away from the walls blank canvas.

Have a look at our ideas for creating bathroom wallpaper for a guest bathroom – which is typically a smaller sized space, to which you can add sparks of personality.

The Guest Bathroom

The guest bathroom is slightly different from a personal bathroom.

Like shared spaces, it’s more common to see imagery, patterns or colours that are more universally accepted or pleasing to the eye.

But, it’s not uncommon for someone to choose to style their guest bathroom with a slightly unique vision in mind – as it’s a lesser-used space and can be an area show off some creativity or take a risk.

Here, some of the themes we’ve already mentioned still reign true. Popular choices include bathroom wallpapers featuring patterns of birds, flowers, plants and a distinct contrast between these forms and a darker or lighter background colour.

Another popular choice, that you might not think of initially when the idea of styling your bathroom is whirling around in your mind – is fish.

Bathroom wallpapers with fish can create a very interesting feel in a small bathroom. This still sticks to the overall theme of nature, but aquatic instead.

The range of blues associated with the ocean makes a fantastic base background for the wallpaper, which is contrasted by detailed and colourful fish forms.

This creates the depth you’re looking for, whilst the theme of nature is consistent and provides a tranquil feel alongside calming blue tones, used to represent the ocean.

The wallpaper design also has a funky, lighthearted feel, as you’re surrounded by fish with different colours, shapes and sizes. The natural intricate detail of a fish provides an eye-catching edge too.

Final part coming soon…

For any practical advice or assistance, call the Tiletoria Sales Team or visit their closest showroom.

bathroom, blog, how to articles, robin sprong wallpapers blog

Finding bathroom wallpaper ideas can be a difficult task, some might even view a bathroom as one of the more challenging environments to style. To help get you started with picking a style for your bathroom wallpaper, we’ve compiled a range of tips for picking wallpaper colours, wallpaper patterns and creating the kind of theme you have in mind:

Which vinyl wallpaper works best in the bathroom?

The fact that there’s moisture within the bathroom space, is a concern but one that can be placated. We will cover ways to deal with this concern later. For some people, choosing their bathroom space is more about not ending up with a standard white and chrome design scheme. Although, there’s nothing wrong with an elegant design scheme, but with bathroom wallpaper, you have a vehicle to emphasise and express any theme or atmosphere that you wish.

This wallpaper, for example, emphasises elegance by taking a vintage, floral-inspired twist. The artist, Jessica Warrwick, loves to illustrate the feeling of fun, whimsical movement combined with the opulent abundance of the natural world. The result is a bathroom wallpaper with muted tones that creates a classy environment.

Choose Your Prefernce from Options Like:

- rustic wallpaper

- modern wallpaper

- floral wallpaper

- landscape wallpaper

- photographic wallpaper

- textured wallpaper designs

Adding a Personal Touch

Unlike a shared space like a living room, which needs to be welcoming to guests, a bathroom is more of an experimental space. It’s popular when styling a bathroom to come across more striking themes and creativity, that relates strongly to a couple or someone’s personal taste. This means that the approach for designing your wallpaper will differ, depending on personal preference, the colour scheme, and fixtures you’ve chosen for the bathroom.

Bathrooms are often associated with the theme of nature which can be important to someone for a variety of reasons.

For some, nature is where they feel at peace. For others, the intricate detail and vibrant colours that nature serves to us on a platter are too much to resist when designing a bathroom wallpaper. Both the atmosphere created by nature and the detail of the wildlife and floral forms are important elements to a natural wallpaper.

The detail of the natural forms is brought to life by specific colours that have a purpose within the piece, the same way nature’s purpose within a bathroom wallpaper provides a sense of calm.

Selecting the right material on which to print your wallpaper

Bathrooms are wet spaces, subject to steam, splashes, spills and drips, wherever they might occur, so you need a wallpaper that will be able to stand the test of time. Steam is a primary factor that makes choosing a wallpaper for your bathroom a bit tricky. Steam can make wallpaper curl and decay designs, so it’s important to pick a durable surface to print your wallpaper on.

For starters choose solid vinyl, fabric-backed vinyl or paper-backed vinyl, as these provide the best splash proof wallpaper surfaces. Picking a plastic-based material will have result in a slight sheen or noticeable reflection, but the plastic nature of the material allows you to clean your wallpaper gently and easily. It also makes the wallpaper slightly water resistant, and this can help with any splashes of water or droplets of moisture left on the walls.

Vinyl wallpaper with a woven backing is also great for the bathroom, as it provides durability against slightly harsher scrubs and nicks. The textured nature of the wallpaper also provides creative room for enhancing the artwork or design. Certain imagery, like rustic wallpapers, vintage wallpapers and floral wallpapers can benefit from this additional texture for added intricate detail.

Part 2- coming soon…

For any practical advice or assistance, call the Tiletoria Sales Team or visit your closest showroom. Tiletoria Paarden Eiland is an official retailer of Robin Sprong Wallpaper so pop in store for inspiration or to get a quote.

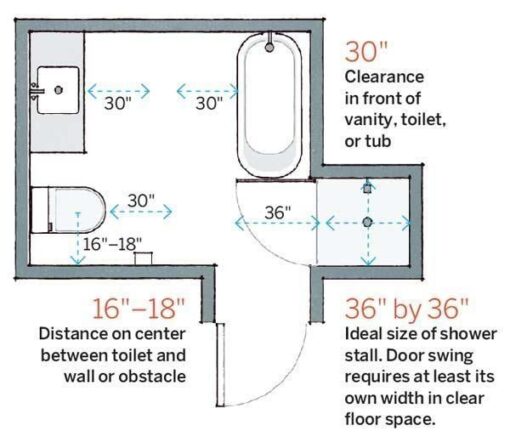

bathroom, blog, renovation tips

Deon Bing knew from an early age that the outdoors were going to form a major part of his life. Surfing, trail running, lake swimming, skating and travelling – squeezing everything out of the day. Fast forward a few years and nothing has changed – his love for the environment has continued to grow. He’s been able to share these passions through his Radio Surf Report for nearly 3 decades. In addition, he brews and distributes his own craft beer and runs a video production company, Bing Digital. He has been an ambassador for Tiletoria for many years, and recently renovated his bathroom. Read about his experience, get some advice and inside tips before starting your own renovations.

What have you got available to spend on completing the bathroom renovation?

PLANNING AND BUDGET

The sanware and the tiles and all the pretty bits to make your bathroom look amazing are just a portion of the final costs.

Additional costs to consider are the adhesive and grout, new power points and light fittings, possibly plumbing upgrades, removal of the old bathroom tiles, basins and baths and delivery and storage of your new materials, ready for installation.

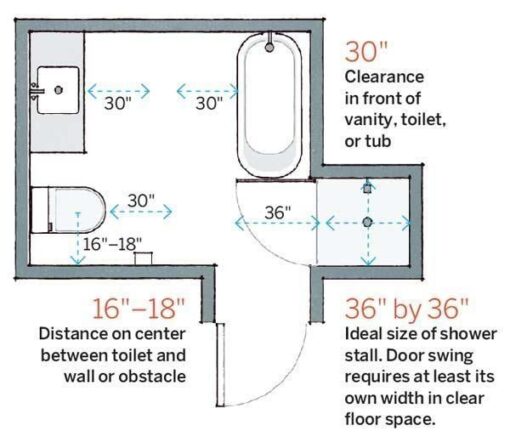

You’ll need to chat to the plumber and electrician before you start, as they’ll need to be there at the beginning during demolition as well as at particular stages along the way – i.e. making sure the power to your backlit mirror or heated towel rail is there before the wall tiles go on, or that the shower will have correct drainage, before you lay the floor mosaic.

Discuss the scope of work required and get a quote from them – and their availability to be on site! They need to schedule their diaries around progress on your bathroom renovation. They’ve done it before and can offer good advice on the pitfalls to avoid.

Anticipate lots of chopping, cutting, mixing and dust – you’ll need to cover and tape the rest of your home to keep it clean.

An experienced project manager takes away a lot of the guesswork and hassle and can also assist with fine tuning a realistic budget, offering alternative solutions – choose wisely.

Budget sorted, layout and design ideas and a plan of action ready – it’s time to visit the Tiletoria showroom!

VISIT THE TILETORIA SHOWROOM

The staff have been involved with numerous creative clients over the years and are able to discuss your ideas and give you detailed advice on each and every aspect of your planned renovation. They can help you avoid costly mistakes.

Their catchphrase is “Luxe for Less” – finding those bespoke, luxurious pieces that will enhance the look of the space, at a great price.

Take a walk with them through the showroom displays to get a better idea of how things will look and work together.

There are options for all budgets, with ranges of baths, basins, taps and toilets to meet all pockets.

Also note how the tiles have been laid, possibly a herringbone layout?

Large format tiles help to visually increase the size of a space – with the added bonus of being easier to clean.

Lighting is just as important, and the showroom displays have been lit to create the perfect mood.

And talking about mood, there are mood boards everywhere. They can even help you create your own, helping you visualise what goes together and how the end product will look. Ask for a sample to take home with you.

The staff will guide you through the process, confirm the stock availability and get everything ready for you to get going on your renovation.

Renovating your bathroom is a process, both a creative one and a practical one.

I was incredibly lucky with the team on site, competent and professional, as well as the selection of tiles and sanware we purchased from Tiletoria. The results were amazing and worth the effort and investment.

Take your time in the planning, chat to the right people, be aware of what your budget is and be realistic about the time it will take to complete.

The sales team at Tiletoria will advise and assist along the way, ensuring you are able to create the bathroom of your dreams, adding value to your home and to your life.

Deon’s Bathroom Before Reno

Deon’s Bathroom After Reno

Deon Bing ©